China's 2025 Rare Earth Export Controls: Strategic Leverage or Supply Chain Disruption?

Listen to this Article

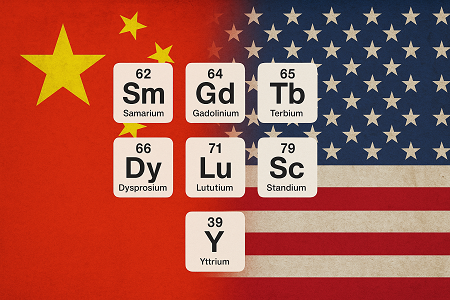

On April 4, 2025, the Chinese government issued Announcement No. 18 of 2025, imposing new export controls on a range of medium and heavy rare earth materials. The directive, issued jointly by China’s Ministry of Commerce and the General Administration of Customs, places strict licensing requirements on the export of Heavy Rare Earth Metals like samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium, as well as their oxides, alloys, and associated compounds. This move has sent ripples across global supply chains, particularly in sectors reliant on rare earth elements (REEs) for high-performance technologies.

This blog post explores the substance of China's new policy, the geopolitical and industrial implications, and how companies and countries are responding.

Understanding the Scope of Announcement No. 18

The document lays out a comprehensive export control regime, citing national security and nonproliferation concerns. The policy mandates that any company seeking to export the listed materials must apply for and receive a special license from the Ministry of Commerce. Customs will not release the goods without confirmation of this license.

The controlled items are divided into seven categories:

1. Samarium-related materials

2. Gadolinium-related materials

3. Terbium-related materials

4. Dysprosium-related materials

5. Lutetium-related materials

6. Scandium-related materials

7. Yttrium-related materials

Each category includes the elemental form, various alloys, oxide compounds, and special-use products like magnet materials and sputtering targets. The announcement clearly defines applicable customs commodity codes and clarifies that these controls are effective immediately upon publication.

Geopolitical Underpinnings

This move is widely viewed as a strategic play by China to reinforce its position in the global rare earth supply chain amid intensifying tech and trade competition with the United States and its allies. Rare earths are vital in applications such as electric vehicle (EV) motors, wind turbines, defense technologies, and advanced electronics. China currently processes about 90% of the world's REEs, giving it outsized influence over this critical sector.

The timing of the announcement coincides with an easing of direct trade hostilities between the U.S. and China. However, the rare earth export controls demonstrate that while tariffs may be easing, resource leverage remains on the table. Analysts suggest that these measures are not only about safeguarding national security but also about retaining bargaining chips in long-term geopolitical negotiations.

Industry Shockwaves and Supply Chain Stress

The announcement has already had tangible effects. Export license approvals have slowed to a crawl, and some exporters report uncertainty about what qualifies as a controlled item. This ambiguity is contributing to customs delays and potential supply disruptions.

Affected industries include:

Electric Vehicles: Carmakers like Tesla, Ford, GM, and Rivian are feeling the pinch. REEs are integral to permanent magnet motors, a core component of EV drivetrains.

Defense and Aerospace: Dysprosium and terbium, for example, are critical in heat-resistant magnets used in military aircraft and missiles. Companies such as Lockheed Martin and Raytheon rely on stable supplies.

Consumer Electronics: From smartphones to hard drives, REEs enable miniaturization and performance. Disruptions here ripple across tech sectors.

Clean Energy: Wind turbine manufacturers, particularly those using direct drive systems, depend on neodymium-iron-boron magnets, often doped with dysprosium and terbium to improve thermal resistance.

China’s Justifications and Enforcement Mechanisms

According to the announcement, the rationale for these controls lies in China’s commitment to international nonproliferation obligations and national interests. However, the breadth of the items controlled, including mixtures and compounds in various physical forms, suggests a broader objective of curbing downstream value chain access.

The policy requires exporters to conduct item identification and explicitly state whether items are controlled in their customs declarations. Customs officers have the authority to detain shipments during verification. If there is a dispute, goods may remain unreleased for an indeterminate period, creating further uncertainty for foreign buyers.

Responses and Workarounds

1. Government Reactions:

Governments heavily reliant on Chinese rare earths, particularly the U.S., EU, Japan, and South Korea, are scrambling to reassess supply chain risks. The U.S. Department of Commerce and Department of Defense have renewed calls to bolster domestic rare earth processing and encourage non-Chinese supply partnerships.

2. Industrial Shifts:

Major manufacturers are accelerating diversification efforts. Australia’s Lynas Rare Earths recently announced successful production of dysprosium at its Malaysian facility, marking a pivotal milestone in rare earth supply chain localization.

3. Policy Measures:

Several think tanks and industry groups are urging Washington to consider targeted tariffs on Chinese magnets, coupled with subsidies for domestic and allied producers. This strategy mirrors earlier efforts in semiconductors and solar technologies. Amazing Magnets’ opinion on this is that it will be not be enacted due to the criticality of the magnets in industry, and the current lack of US production.

4. Supply Chain Innovation:

Companies are investing in rare earth recycling technologies and researching substitutes. For example, some motor manufacturers are exploring magnet-free drive technologies, though these are not yet viable at scale.

Signs of Hope: Domestic Revival and Innovation

While the short-term shock is real, there are also signs that the U.S. and its allies are not entirely unprepared. The Mountain Pass rare earth mine in California, once a dormant relic, has undergone a remarkable transformation. Now operated by MP Materials, the mine has reemerged as a strategic asset in the effort to rebuild America’s rare earth independence. Until just recently MP Material was sending US RRE material to China for processing, but as of April 2025 has halted all exports of its rare earths to China paving the way to bring downstream refining and magnet manufacturing back to U.S. soil.

Other U.S.-based companies are making headway in rare earth mining and processing, bolstered by growing private investment and government incentives. Innovations in sustainable mining practices and advanced recycling technologies are also accelerating. The progress is incremental, but the trend is promising: a slowly maturing domestic ecosystem that could eventually insulate the U.S. from future disruptions.

A Calculated Move with Lasting Impact

By restricting access to materials that underpin 21st-century technologies, China is leveraging its near-monopoly in a high-stakes geopolitical game. While Beijing insists the move is regulatory and non-political, the ramifications are inherently strategic.

The policy effectively forces foreign firms and governments to rethink their sourcing strategies, invest in alternative supply chains, and even redesign products. In the short term, this will cause supply bottlenecks and price volatility. Long-term, it could accelerate a shift in global rare earth dependency away from China—but only if alternative producers can scale quickly.

Conclusion: Decoupling or Diversification?

China’s Announcement No. 18 of 2025 is more than a bureaucratic update; it is a declaration of intent. The world is now watching to see whether this move leads to further decoupling in critical material supply chains or a more balanced diversification that reduces geopolitical risk.

For businesses, the imperative is clear: reassess exposure, invest in supply chain resilience, and engage with policymakers to ensure strategic materials remain accessible. As the race for technological supremacy heats up, rare earths have become the new oil and China just reminded the world who controls the tap.

Yet, the message isn't all bleak. With renewed focus, investment, and policy support, the United States and its allies are laying the groundwork for a more resilient and diversified rare earth future. The wheels are turning, and with continued momentum, the global rare-earth landscape may look very different in the decade ahead.

One of the promising hopes on the horizon is alternate formulations of the Rare Earth Magnets. Due to the export restrictions on Dysprosium (Dy), the new forerunner Cerium (Ce) may be coming to more Neodymium Magnets soon. Cerium (Ce) is a Light Rare Earth Element (LREE) whereas Dysprosium (Dy) is a Heavy Rare Earth Element (HREE), so it avoids the current export restrictions.

This year has been a whirlwind of laws, and political tug-of-war, but things will go smoothly again, the rare earth metal market will again stabilize and become a new normal – it just takes time. Amazing Magnets will continue to service our customers to the best of our ability, as we navigate this time of uncertainty.

Read the complete Announcement 18 in 2025 (Chinese & English)